Tally 109

Journal Voucher Creation

The said voucher is used for

“Any type of Non-Cash or Non-Bank transaction, Fixed Assets (Non-Gst) purchased through credit, Credit Expenses (Non-gst), Adjustment entries like Rebate & Discount, Depreciation, transfer of one a\c to other, salary wages, other payable expenses, Prepaid Insurance and Expenses Receivable etc.”

Gateway of tally (GOT)

↓

Press ‘F7’ Journal

↓

Fixed Asset Purchase (Credit and Non-GST)

DR: Name of the Asset

CR: Name of the Creditor from where purchased

Expenses (Credit and Non-GST)

DR: Expenses Head

CR: Name of the Creditor from where purchased

Salary & Wages Paid (Credit and Non-GST)

DR: Salary/Wages Paid

CR: Salary & Wages Payable

Journal Voucher Creation -Example

(Already created company named M/s SMD Marketing Co.)

Problem

1. Discount allowed Rs.100/- on receipt of payment from ABC & Co.

2. Discount received Rs.210/- on for making payment to XYZ & Co.

3. Depreciation on computer Rs.4000/- (40% on Rs.10000/-)

4. Salary due for April Rs.27000/-

Solutions:

In the above problems following ledger accounts are required to create:

Rebate & Discount A\c under Indirect Expenses or Indirect Income

ICICI bank under bank Accounts

ABC & Co. under Sundry Debtors

XYZ /& Co. under Sundry Creditors

Depreciation Account under Fixed Assets

Salary paid under Indirect Expenses

Salary Payable under Current Liabilities

For Voucher Creation press ‘V’ at GOT (Gateway of Tally) and ‘F7’ for Journal voucher.

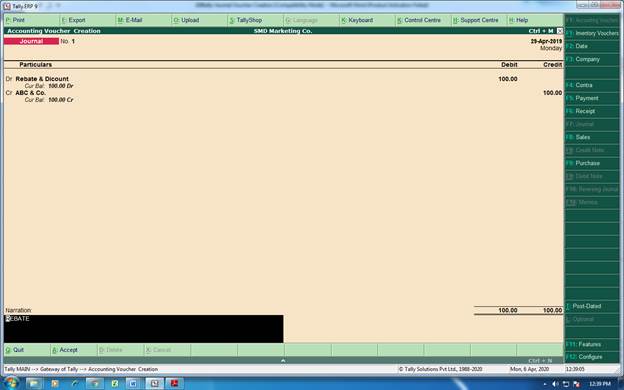

Problem:1

Dr: Rebate & Discount

CR: ABC & Co.

The view shall be as under:

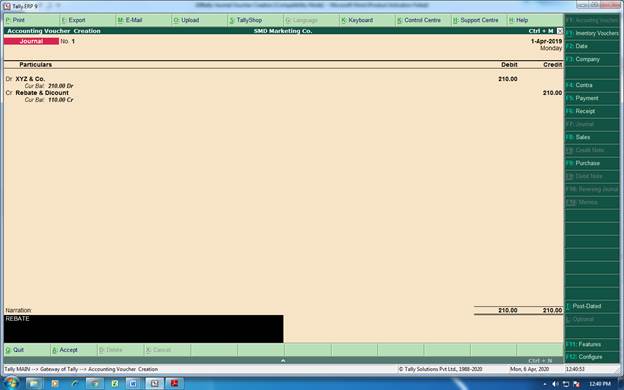

Problem: 2

Dr: XYZ & Co.

CR: Rebate & Discount

The view shall be as under:

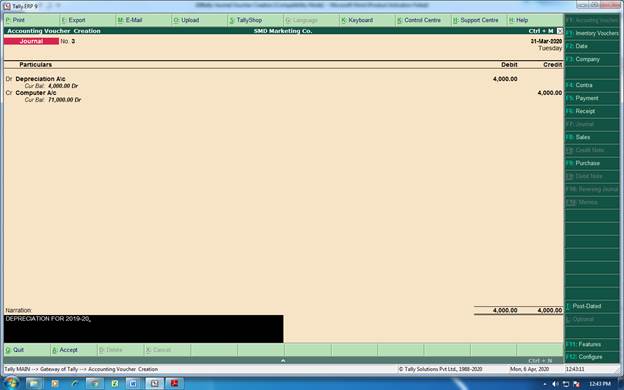

Problem:3

Dr: Depreciation A\c

CR: Computer A\c

The view shall be as under:

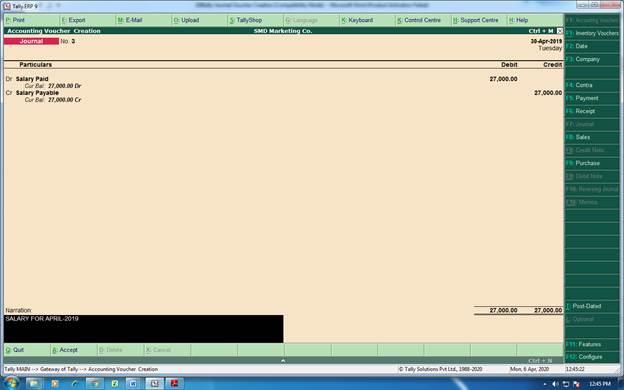

Problem: 4

Dr: Salary Paid A\c

CR: Salary Payable A\c

The view shall be as under: